Back News / Flashback 2019: PE-VC exits drop but these investors minted money

Flashback 2019: PE-VC exits drop but these investors minted money

December 30, 2019https://www.vccircle.com/flashback-2019-pe-vc-exits-drop-but-these-investors-minted-money/

Private equity and venture capital exit deals in India dropped in both volume and value terms this year, but a few investors managed to make handsome returns thanks to improved liquidity in an otherwise volatile stock market.

The year gone by recorded nearly five dozen deals where investors made a complete exit with the bulk of the activity taking place through public markets, according to data compiled by VCCircle. Factoring partial exits, this year saw a total of 150 exit transactions compared with 170 last year and 236 in 2017.

Public-market deals had the highest share in the number of exits this year, despite a slow year for initial public offerings. This was followed by mergers and acquisitions, and secondary deals.

Interestingly, the IPO pipeline is building up again on the back of renewed confidence that Prime Minister Narendra Modi’s massive victory in the general elections in May will improve sentiment and revive economic growth.

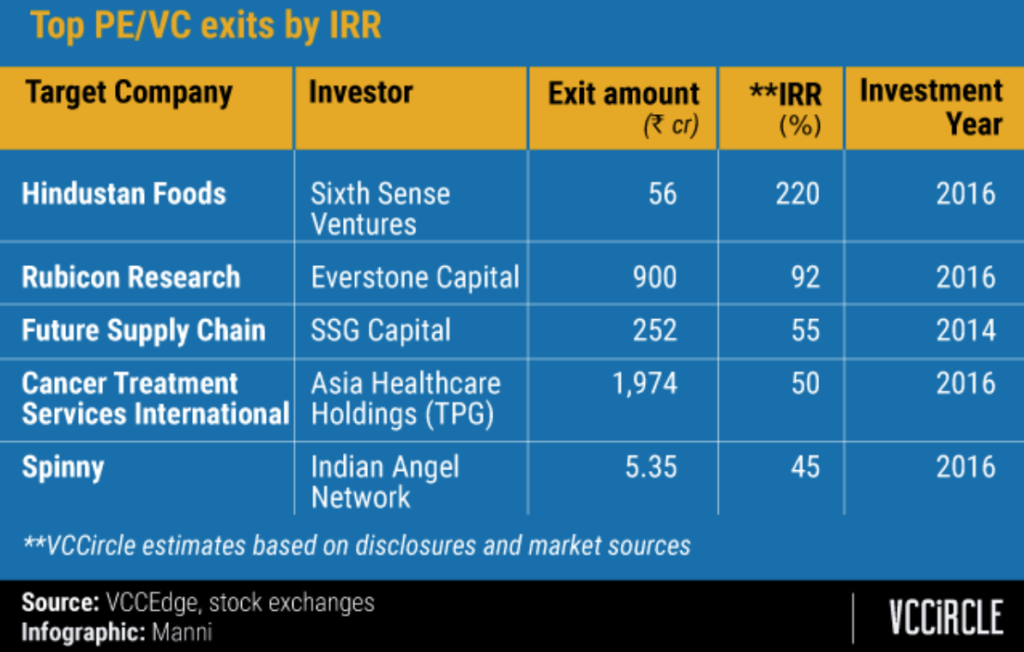

All five of this year’s top exits by value made money for the investors, with three of those being multi-baggers. Here’s a quick look at some of the top exits this year:

Sixth Sense Ventures—Hindustan Foods

Nikhil Vora-led Sixth Sense Ventures fully cashed out of its near two-and-a-half-year investment in publicly listed Hindustan Foods Ltd. This deal marked one of the highest returns earned by a VC firm in India.

The Mumbai-based investment firm clocked a seven-fold return on its investment in the contract manufacturer for fast-moving consumer goods companies.

Sixth Sense had invested Rs 8 crore in December 2016 for a 15.4% stake in the Goa-based company, which makes Kurkure brand of snacks for PepsiCo Inc. It fetched Rs 56 crore, clocking 220% IRR. Sixth Sense’s stake was bought by homegrown public markets-focussed PE firm WestBridge Capital Partners.