CNBC Investment Guide: What will drive consumption in the post-COVID era?

Sixth Sense Ventures | October 21, 2020

https://www.cnbctv18.com/videos/business/investment-guide-what-will-drive-consumption-in-the-post-covid-era-7263461.htm

Investment Guide: What will drive consumption in the post-COVID era?

As the economy goes through various stages of unlock, and everyone tries to limb back to some semblance of normalcy, the big question is are people going to open up their purse strings. And if they are, what will they spend on.

Nikhil Vora, Founder & CEO of Sixth Sense Ventures said that pandemic has cut short the time in which certain changes were to happen.

“A lot of times there has to be something drastic that happens and changes the way businesses operate and that event basically cuts short the time period which is required for the change to happen. COVID in India is possibly one such moment,” he said.

According to Vora, brand loyalty in India is at an all-time low and brand awareness is at an all-time high.

“This is a great case for disruption to happen. So, unlike in the past, now new-age brands, both on the physical side as also on the B2C side, have an ability to take 2-10 percent market share which possibly they would have taken over a 5-7 year period if they survived, to now possibly taking that sort of market share in a 3 year period,” he said.

Inventus, Sixth Sense, Blume & Norwest win Apex’20 Venture Capital Awards

Sixth Sense Ventures | May 26, 2020

https://ventureintelligence.blogspot.com/2020/05/inventus-sixth-sense-blume-norwest-win.html

Inventus Capital Partners, Sixth Sense Ventures, Blume Ventures and Norwest Venture Partners were voted the top Venture Capital investors in India during 2019. The Venture Intelligence “Awards for Private Equity Excellence” (APEX) is dedicated to celebrating the best that the Indian Private Equity & Venture Capital industry has to offer. Other 2019 winners in the VC segment included Axilor Ventures which was voted the Accelerator of the Year for the second year running, 3one4 Capital (VC Fund Raise of the Year) and Innoven Capital (Venture Debt firm of the Year).

The APEX Awardees are selected based on both Self Nomination by the participating PE-VC firms as well as "crowd sourced" nominations and voting from the Limited Partner, PE-VC and advisory communities. (The main criteria are Exit Track Record, New Fund Raises & Follow-on Funding Rounds for Portfolio Companies).

"It is an honour to be recognised by entrepreneurs and investors as India's No 1 startup accelerator, two years in a row," said V Ganapathy, Co-founder, Axilor Ventures. "This is clear validation of the program value and the strong market network we have built at Axilor. We are also delighted to have been part of the journeys of so many successful startups," he added.

"Its an honour to be considered for this award category." said Sanjay Nath, Managing Partner, Blume Ventures. "Seed funds are tasked with backing entrepreneurs seeking to re-invent the future. These turbulent times have made seed investing even more challenging; on the other hand, its a great time to rebuild and rethink how user and enterprise behaviors are shifting, and back innovative ideas with a brand new canvas," he added.

"Over the last decade, we've seen the Indian startup ecosystem evolve into a rich and vibrant ecosystem. The consistent growth in quality of entrepreneurs and companies has enabled us to continue doing our job and we feel truly humbled to be selected as the best Early Stage VC by the startup ecosystem," said Rutvik Doshi, Managing Director, Inventus Capital India.

"It's an honour and a matter of pride for Sixth Sense to be accorded (this award). With humility, I accept the award as we remain steadfast in our resolve of 'Investing in the Consumer of Tomorrow...today!'," said Nikhil Vora, Founder & CEO of the stage agnostic Sixth Sense Ventures which was the Co-Winner in the Early Stage VC category. "Our fiduciary responsibility is to optimise returns for our stakeholders. A job made quite easy by the 'smart ass' founders, working in a 'big ass' market with a 'kick ass' product. It's said, 'work hard in silence, let success make its noise'. All I can say is that, We have just started the journey!" he added.

"We are delighted to receive the Growth Capital VC of the year award! For Norwest India, in addition to several new investments and follow-ons, our exits continued to remain our focus and we managed to completely exit 6 SaaS companies in addition to significant partial exits as well," said Niren Shah, Managing Director and Head of India at Norwest Venture Partners India. "We have received back to back awards and will hope to maintaining the winning streak in the coming years as well."

"We are happy to accept this award and are very grateful for the support and acknowledgment from the investment community, and for everyone's feedback as we scale the firm." said Pranav Pai, Founding Partner of 3one4 Capital, which won the VC Fund Raise of the Year award. "India's nascent startup scene is complemented by the growth of the domestic Fund Management industry. Investments by AIFs in India have grown at a CAGR of 84% since 2015. New Fund Managers are entrepreneurial as they seek to disrupt the VC industry. 3one4 has grown capital under management by 16x over the same time period. Awards such as this help highlight these emerging trends and we're honored to be a part of this year's cohort," he added.

"The last five years have been an intense period of growth for India's alternative investment sector, and 2020 promises to support more progress. While the early-stage entrepreneurs focus on cracking the product-market fit, we have focused on mobilizing more of the domestic capital within the country to support the emergence of strong brands that set an example with high-governance. We hope to pay this incredible honor forward and will continue to support the industry so that we may all contribute towards India becoming a standard-bearer for the growth of the next set of generational companies. We are very grateful for the extraordinary support from the ecosystem, and we remain committed to playing our part in growing the asset class as India scales to its $5 Trillion GDP target," added Siddarth Pai, Founding Partner of 3one4 Capital.

“We are excited to get this recognition, which is a testament to the accomplishments of our portfolio companies," said Ashish Sharma, CEO of InnoVen Capital India. "We believe that the venture eco-system will play a critical role as the economy moves faster towards low-touch, digital and tech enabled business models. We look forward to continue backing great founders and innovative business models that have the potential to make a meaningful impact,” he added.

Venture Intelligence also took the opportunity to request the winning investors to provide their take on the Emerging (Covid-19 impacted) VC-Startup landscape in India. Some reactions:

“We are going through unprecedented times with a lot of uncertainty around public health and the state of the economy. However, as VCs we are born optimists and we do believe that the crisis will be behind us soon. Every crisis and downturn redefines the way we do things and smart entrepreneurs will emerge during this crisis too who will build the products and tools to shape our lives going forward. We will be looking for such smart entrepreneurs and are open to backing them.” - Rutvik Doshi, Managing Director, Inventus Capital India.

“The venture ecosystem is indeed going through a perfect storm with demand destruction, supply chain disruption and funding market dislocation. While this has created a challenging environment for most start-ups, the new normal is also helping some sectors to scale up faster. We expect that there will be some profound changes to customer behaviour, which will lead to a faster transition to new age business models. There are some valid concerns around growth/late stage funding in the medium term but I am quite encouraged by the strong early stage funding activity. For early stage companies, there is adequate dry powder and investors are keen to back founders who can discover large opportunities, innovate fast and build sustainable business models” - Ashish Sharma, CEO of InnoVen Capital India.

“These are trying times indeed, with the pandemic gravitating to a global economic crisis, with a high degree of business uncertainty around. That said, seed (in particular) and early stage (broadly) investing is a 10+ year “long game” and hence all investable startups should be Covid-proof. India continues to be a key talent hub for the world, besides having a massive domestic market. The landmark Facebook-Jio deal has brought digital to the forefront, with venture well positioned to ride on these tailwinds. This digital inflection point plays directly into the exciting consumer and enterprise startups we see every day. This is also an opportune time to self-correct, and valuations will be more accurately priced. We’re seeing more signs of high quality founders starting up, and believe our ecosystem will emerge stronger and more resilient.” - Sanjay Nath, Managing Partner, Blume Ventures.

“We believe that the Covid impact on India and globally is going to be significant, but we remain bullish and committed to the India growth story in the long term. We remain active on new deployments in the Growth Equity space and will now invest out of our new $2 Billion global fund which we raised in end 2019. We are very keen to support dynamic & agile management teams, strong business models and companies which will convert this adversity into an opportunity.” - Niren Shah, Managing Director, Norwest Venture Partners India

Venture Intelligence is India's longest serving provider of data and analysis on Private Company Financials, Transactions (private equity, venture capital and M&A) & their Valuations in India.

If You Fail, Fail Fast, Die Young: Nikhil Vora, Sixth Sense Ventures

Sixth Sense Ventures | January 24, 2020

http://www.businessworld.in/article/If-You-Fail-Fail-Fast-Die-Young-Nikhil-Vora-Sixth-Sense-Ventures/23-01-2020-182649/

What does it take to effectively launch a business, and be on the road to success? The founder and CEO of Sixth Sense Ventures, Nikhil Vora, reflects on the dos and don’ts of being a successful entrepreneur.

He said, “In every business that one does, the idea is to look forward to what we can do and build further on it. Entrepreneurship is also about the belief that we will tackle things as they come. It happens with arrogance, which is a brilliant thing to have for entrepreneurs.”

“For all of us, it is important to know where we want to be and the path to that could be different. Sometimes, we should also know that when we are on the wrong path and the business that you thought will have the longevity, may no longer exist. So you should know when to cut short,” he added.

He asserted that entrepreneurs today have numerous lives whereas a decade back they only had one life. He stated, “If you fail, fail fast, die young and live again because you will have a chance to do it again.”

Giving an alternative viewpoint to his earlier statement of having belief in what you do, he said, “Your belief should also be tested every now and then. If tomorrow the market doesn’t exist which you are a part of, you can’t be sticking onto it if you have to be relevant.”

Vora explained that there is a tendency for people and for businesses, even politics and economy, to overestimate what will happen in the very near term and underestimate the impact of the same in the longer term.

In the Indian case, highlighting the past government initiatives such as GST, Bankruptcy Code, Demonetisation and Direct Transfer, he said, “All the event calendars which have happened, at first looked like the biggest event and thereby our expectation that these events should unfold impact lot more sooner. But in retrospective, if I had to look at this, I would want to believe that this could be the most meaningful changes which would happen in the Indian economy over a period of time, keeping aside right or wrong part of it.”

Concluding his address while speaking at the BW Businessworld and BW Disrupt TechTors, he asserted, “Disruption is going to happen to you or because of you. Businesses do get disrupted and they will disrupt if you don’t disrupt your business. And in India, we don’t see that happening much.”

Flashback 2019: PE-VC exits drop but these investors minted money

Sixth Sense Ventures | December 30, 2019

https://www.vccircle.com/flashback-2019-pe-vc-exits-drop-but-these-investors-minted-money/

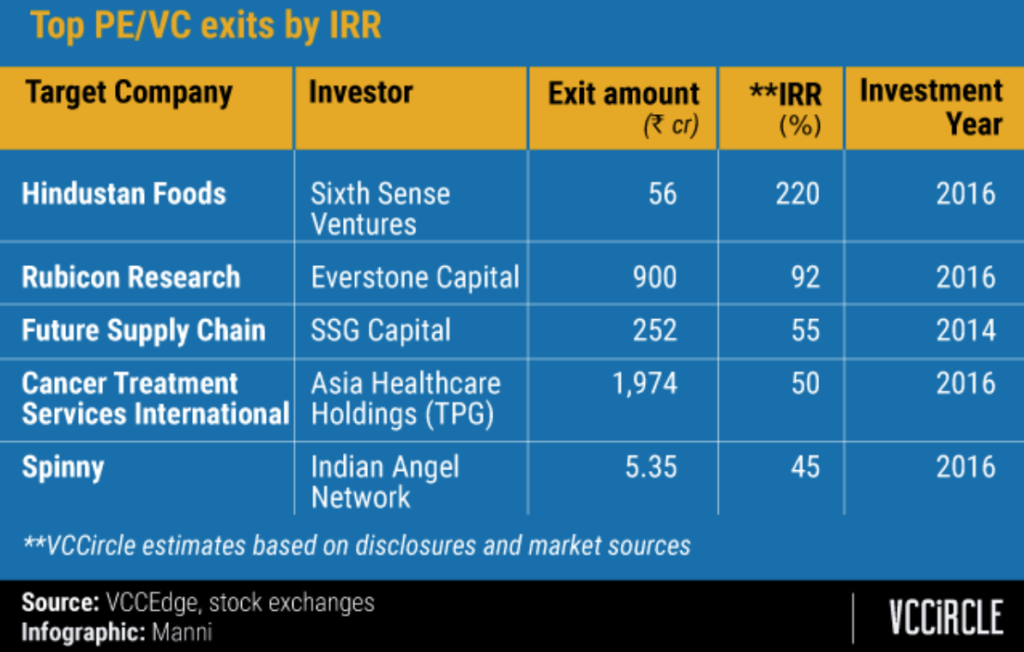

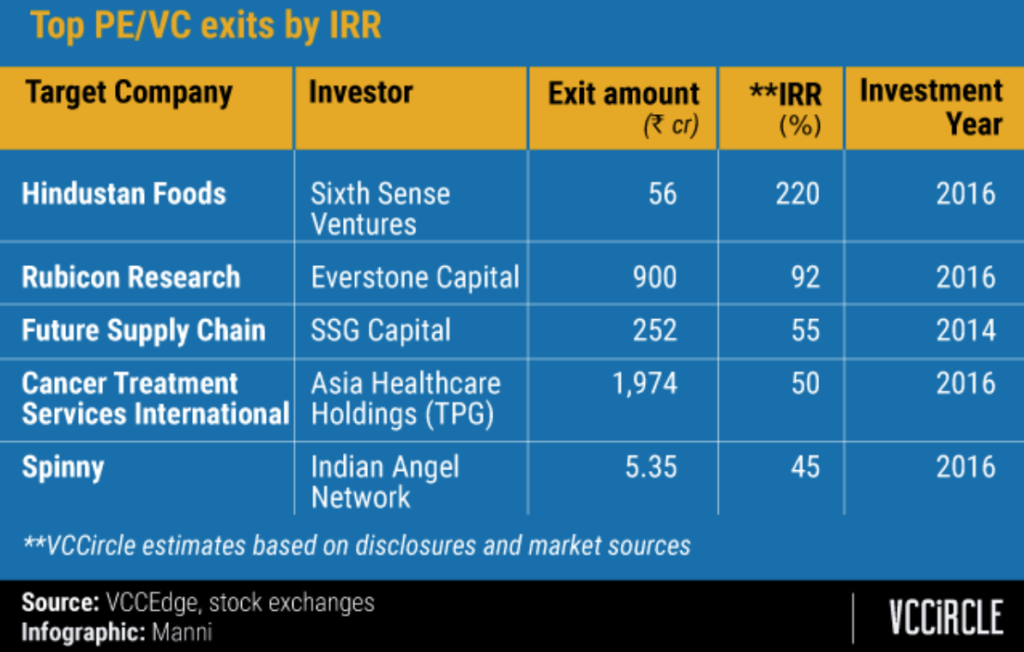

Private equity and venture capital exit deals in India dropped in both volume and value terms this year, but a few investors managed to make handsome returns thanks to improved liquidity in an otherwise volatile stock market.

The year gone by recorded nearly five dozen deals where investors made a complete exit with the bulk of the activity taking place through public markets, according to data compiled by VCCircle. Factoring partial exits, this year saw a total of 150 exit transactions compared with 170 last year and 236 in 2017.

Public-market deals had the highest share in the number of exits this year, despite a slow year for initial public offerings. This was followed by mergers and acquisitions, and secondary deals.

Interestingly, the IPO pipeline is building up again on the back of renewed confidence that Prime Minister Narendra Modi’s massive victory in the general elections in May will improve sentiment and revive economic growth.

All five of this year's top exits by value made money for the investors, with three of those being multi-baggers. Here's a quick look at some of the top exits this year:

Sixth Sense Ventures—Hindustan Foods

Nikhil Vora-led Sixth Sense Ventures fully cashed out of its near two-and-a-half-year investment in publicly listed Hindustan Foods Ltd. This deal marked one of the highest returns earned by a VC firm in India.

The Mumbai-based investment firm clocked a seven-fold return on its investment in the contract manufacturer for fast-moving consumer goods companies.

Sixth Sense had invested Rs 8 crore in December 2016 for a 15.4% stake in the Goa-based company, which makes Kurkure brand of snacks for PepsiCo Inc. It fetched Rs 56 crore, clocking 220% IRR. Sixth Sense's stake was bought by homegrown public markets-focussed PE firm WestBridge Capital Partners.

Sixth Sense Ventures—Hindustan Foods

Nikhil Vora-led Sixth Sense Ventures fully cashed out of its near two-and-a-half-year investment in publicly listed Hindustan Foods Ltd. This deal marked one of the highest returns earned by a VC firm in India.

The Mumbai-based investment firm clocked a seven-fold return on its investment in the contract manufacturer for fast-moving consumer goods companies.

Sixth Sense had invested Rs 8 crore in December 2016 for a 15.4% stake in the Goa-based company, which makes Kurkure brand of snacks for PepsiCo Inc. It fetched Rs 56 crore, clocking 220% IRR. Sixth Sense's stake was bought by homegrown public markets-focussed PE firm WestBridge Capital Partners.

Sixth Sense Ventures—Hindustan Foods

Nikhil Vora-led Sixth Sense Ventures fully cashed out of its near two-and-a-half-year investment in publicly listed Hindustan Foods Ltd. This deal marked one of the highest returns earned by a VC firm in India.

The Mumbai-based investment firm clocked a seven-fold return on its investment in the contract manufacturer for fast-moving consumer goods companies.

Sixth Sense had invested Rs 8 crore in December 2016 for a 15.4% stake in the Goa-based company, which makes Kurkure brand of snacks for PepsiCo Inc. It fetched Rs 56 crore, clocking 220% IRR. Sixth Sense's stake was bought by homegrown public markets-focussed PE firm WestBridge Capital Partners.

Sixth Sense Ventures—Hindustan Foods

Nikhil Vora-led Sixth Sense Ventures fully cashed out of its near two-and-a-half-year investment in publicly listed Hindustan Foods Ltd. This deal marked one of the highest returns earned by a VC firm in India.

The Mumbai-based investment firm clocked a seven-fold return on its investment in the contract manufacturer for fast-moving consumer goods companies.

Sixth Sense had invested Rs 8 crore in December 2016 for a 15.4% stake in the Goa-based company, which makes Kurkure brand of snacks for PepsiCo Inc. It fetched Rs 56 crore, clocking 220% IRR. Sixth Sense's stake was bought by homegrown public markets-focussed PE firm WestBridge Capital Partners. India Inc.’s Failure To Disrupt Is A Wealth Erosion Risk, Says Nikhil Vora

Sixth Sense Ventures | July 30, 2019

https://www.bloombergquint.com/bq-blue-exclusive/india-incs-failure-to-disrupt-is-a-wealth-erosion-risk-says-nikhil-vora

Large listed consumer-focused businesses in India have matured and face the risk of wealth erosion as they have been found wanting in their ability to innovate and disrupt, according to investment fund manager Nikhil Vora.

Disruption is not happening in the listed space, but only among startups, Vora told BloombergQuint on the sidelines of Alpha Ideas 20-20. “You will have exceptions, but exceptions don’t make the rule.”

I think the failure in India is the inability of the leaders to take the risk of disrupting their own existing businesses and losing what they are at today, to the obvious risk of losing the entire business tomorrow - Nikhil Vora, CEO, Sixth Sense Venture

And it’s true for India’s entire business landscape, said Vora, founder and chief executive at Sixth Sense Venture, citing the example of banking and financial services. Disruption in the sector is not being led by State Bank of India and HDFC Bank Ltd., but by a Bajaj Finance Ltd. and a Paytm.

Similarly, he said, Hindustan Unilever Ltd. and ITC Ltd. are not leading disruption in consumer businesses, but startups have taken the lead. When such new ventures successfully disrupt niche areas, he said, their ability to scale up becomes more apparent.

Vora has invested in a host of ventures in early states, including B9 Beverages Pvt. Ltd., the maker of Bira beer; One97 Communications Pvt. Ltd., the parent of Paytm; online retailer Nykaa; and Gowardhan Diary, the producer of Go Cheese.

He is amazed hoteliers or automobile companies have not been effective for consumers on a 10-year-forward basis. Hoteliers are not able to create the relevant supply, and haven’t gone where the consumer is going, he said. Even if the disruption was caused by technology-enabled models, there is no reason why market leaders couldn’t do what Ola, Oyo and others have done, according to Vora. He hopes, but doesn’t believe, that the leaders of today will change and disrupt.

That’s also a reason why he isn’t worried by the ongoing slowdown in consumption, reflected in declining car sales to easing volumes of the makers of staples to shampoos.

Things are not all gloom and doom if looked at from the perspective of disruptors, according to Vora. Numbers will appear lagging for soaps and shampoos, beverages, oral care and cigarettes, but those are not the categories where growth is happening, he said. Those are the categories that have saturated, and incremental growth is always going to be price-driven, not volume-led, he said.

People are consuming products in a very different fashion than traditionally, Vora said. “We need to look at consumer companies’ volumes through inclusion of different categories, and not the traditional ones.”

Brand loyalty is at an all-time low but brand awareness is at an all-time high, said Vora, reiterating that how large listed companies aren’t disrupting existing brands to create relevant ones for tomorrow.

He cited Titan Company Ltd. as an example. The company is evolving, but Titan as a watch brand it will struggle, unless it evolves into categories and sub-brands which the customer of tomorrow will be open to adapt, he said. “Companies need to start mushrooming newer brands, as the days of lesser and bigger brands may be behind us.”

“HUL thirteen years ago started to talk about the superbrand strategy, and contracted the brand offerings from 110 brands to 30 brands. Maybe, the time is right to say that 30 brands is not good for India. Consumers have a choice—consumers want a choice,” he said.

Companies can’t force-feed the consumer anymore, according to Vora, as they will not be able to push brands through the distribution channel. They will have to give what the consumer wants, leading to evolution of brands, he said.

If I were Sanjeev Mehta (chairman and managing director of HUL), I would be worried—that suddenly half a million customers who were buying offline, who were buying in traditional stores, where Lever’s (HUL’s) strength is, have moved online. The customer has moved, companies haven’t.

And there lies is advice for investors. Given the changing dynamics, he expects time correction, not price correction, for a bunch of companies in India. ITC Ltd. has gone through a period of price correction over the last 10 years, Vora said, adding that he expects that for a lot of other consumer businesses. “One can see a prolonged period of time correction in them.”

Here’s the full transcript of the conversation:

You mentioned that the listed space is either dying or will be dead soon, those companies will probably not create value. That’s strange coming from someone who has been in listed market throughout his life.

That’s pretty ironic, I keep thinking about this. I have spent almost 90% of my working life in listed market, was 25 years in listed market and yet when I look at the market, I have looked at it for some time now. I feel that India is at the zone where listed businesses are pretty much businesses which are mature and lived their life cycle. The ability to innovate and disrupt existing businesses is found to be wanting. I don’t see them playing the disruptor role, which is so critical in a market like India, where disruption is seen as an apt thing to do. I keep reflecting this, if I look at Fortune 500 and I have talked about this often. I see 90 percent of them die or become irrelevant over a period of time. I see listed market in India pretty much symbolic of Fortune 500 companies. They die or become irrelevant over a decade in cycle. The market behavior that one has seen over the last three to four years, while it pains all of us, our investors also, but it doesn’t really surprise me so much. This is something which was just waiting to happen. It happened faster then what one should have envisaged, but I don’t see that changing drastically. I am not saying as market momentum and stuff, but I think businesses slowly will erode unless and until they change and disrupt. And I don’t see the ability to disrupt existing leadership to be of a very high order or its in a very few spaces and I see that happening at a galloping space in private companies, private entrepreneurs, first generation entrepreneurs who are really taking this opportunity to disrupt market leaders. That’s the reason why Sixth Sense was formed. We thought we will invest in disruptors in consumer space. So, you know what I said in the Alpha 20 Ideas is pretty much what I believe in. Existing players, existing listed companies even if they are leaders, their ability to maintain leadership and sustain value that leadership is going to be extremely challenging. You will have exceptions, but I believe exceptions don’t make the rule.

It may well be that the current set of examples that you are seeing in listed space are not doing that because being listed is not a pre-requisite to not be disruptive. At some point of time over next 2-4 years even large listed companies could probably throw out a niche or two could be disruptive and change the model?

Yes, I agree. Like I said exceptions will be there. But when I look at broader businesses in our country right now, look at banking. You have a dominant leader in State Bank of India or HDFC Bank, but the disruption in financial services is not being led by an SBI and HDFC. It is being led by players outside that context. It’s being led by a new age consumer finance company let’s say Bajaj, which has evolved in last 7-8 years, or Paytm in some form or lot of other Fintech companies as we look at it. Disruption in financial services, which should ideally have been led by existing leaders is not being done by them.

Disruption in consumer businesses, which is close to my heart is not being led by Levers of the world or ITCs of the world and the Colgate of the world, is being led by new age businesses who are doing it in niche, in spaces which they are very comfortable doing, but the more they get comfortable in particular niche, the ability to do scale becomes more apparent. So, a Lever is not disrupting the space or ITC is not doing it. You see newer players, a Veeba is doing it in some form. You start to see it in Bira for instance, I am being biased because we own stakes in these companies. Bira is doing it in alcoholic liquor space and Parag is doing it in milk and so on. These are all relatively new age businesses which have evolved, and you will see lot many develop.

My fear and this true in a lot of it. Look at print, which Is very close to you guys, I have looked at that space not a single print player and we are talking about large existing players like the Bennett Group, Times. Look at HT for example, Jagran, so the top 3-4 players and not a single player and I am being critical of them. Not a single player has innovated and disrupted how print should be in India for the next 10 years, how Indian consumers will consume print over next 10 years. They are not going to consume print by reading a newspaper any more or that is becoming slightly irrelevant over a period of time. You have seen players evolve in that category. So, Inshorts has evolved whereas the leaders have not really done the development. Look at Auto, very interesting example. In world where top 3 Auto companies actually lose money, the GMs, the Fords and the Chryslers of the world actually lose money. You have it in India where the largest players the Tatas, Mahindra, Maruti for instance have done practically zero innovation or zero disruption in the category. Auto is a space which is getting disrupted almost completely with the advent of the Olas and the Ubers of the world. Ironically, I remember, Mr. Mahindra at some stage talking about the fact that they will have consumption issues because the sharing capability of Ola and Uber will increase and thereby people will not have cell phone cars. I fail to understand why a forward looking corporate like Mahindras could have not created an Ola in India.

But none of the hotel chains thought of creating Airbnb, aren’t these essentially tech companies which are coming out and consumer tech companies which have managed to do this. Your complaint is legitimate that the original product owners could have also thought about being consumer tech but have not thought of doing so.

Precisely my point. Hotels, beautiful example of a business like the Taj and Oberoi and all other chains that we look at. They have been static players, they have been brilliant at the product, so nothing taking out from all the guys who have done whatever they have done. But the fact is they have been ineffective for the consumer 10 years forward. What have they done to ensure that the costumer base that they have established in Taj or Oberoi moves along with them. They can move along with them only when Taj sets up another Taj. They have lost the costumers because in India you have a situation where there is so much of balance sheet that has been invested in our country. All of us somewhere have invested balance sheet capital, created asset. An Oyo proved that they could create a model, I am not talking about how Oyo succeeded financially. They have done it in terms of capital raise and so on. I think they have shown the way of what one could do with the balance sheet capital investing in our country. I fail to understand why a Taj or look close to one of our portfolio companies Saffronstays, they have created this premium holiday home play which is about literally all the assets created by us who bought the next holiday home and so on. There is no reason why Taj should not be doing that, there is no reason why Mahindra Holidays should not be doing that. They have members, they have demand, they failed to create supply which is the worst thing that can happen in the business. Businesses struggles when they don’t have demand, here, ironically, we have all leaders who are struggling because they could not cope with the relevant supply that the consumer was wanting. They have demand. A banking channel has demand that’s why you are talking about unbanked bank, micro finance and tertiary banking and so on. Automobile have it, Ola and Uber are proving that. they have not gone to where the consumers are going.

Even if it means pure tech or significantly tech enabled, there is no reason why leaders could not do that, and you had startups doing that role. I think the failure in India as of now is about leaders’ inability to take the risk of disrupting their own existing businesses and the fear of disrupting their own business and thereby losing where they are at today, to the obvious risk of actually losing the entire business tomorrow. I think that I very ominous to them and I frankly hope, but I don’t have too much belief while I hope of that, but I don’t have too much of belief that leaders have ability to change. It is very tough; it requires someone to take that ownership. Professionals very rarely will take that ownership, it must be the entrepreneurs, the promoters who must take that call and hope some of them do.

Lets draw the conversation to consumption, two things. When I look at the set of portfolio companies that you are invested in they are anything but traditional. When I look at the listed space the only pocket where valuations are still held out despite trends starting to come off is consumers. How do you see this dichotomy, or these things shape up?

India has never or very rarely let me say that has been a value market. India has been a growth market. All of us somewhere get trapped in believing that value is what we want to protect, and we are good at capturing the value. Our failure is when we don’t catch growth along with that value and to me Indian market is symbolic of that form. We think that because markets have collapsed the values are becoming very enticing. I think that is not really the case. It’s about saying whether the values are falling, the growth is still sustaining. We don’t have that happening right now. If I look at consumers or frankly any business for that matter is that in the listed market also, while everything around us has possibly collapsed by 50 percent if not more over the last 3 years, we have invested in two listed companies in the same period. We have made 7 times and 10 times the money in two listed companies in the same period. Not saying we did something Earth shattering about it, but the fact is that there are pockets of businesses and sponsors which we think are playing the disruptions which the leaders are not able to do, and they can’t participate in that disruption. So, for instance we invested in contracting, that was a big thing because consumer contracting has become very large.

We believe that the leaders will find it a struggle to grow beyond where they are. They will not grow meaningfully. If they don’t grow meaningfully then they have to let go of what is tertiary to them because they have to grow and keep sustaining their brands and so on. They will protect their 60 percent ROI business which is brands and let go of manufacturing which is 16-17 percent of ROI business. That’s the great opportunity we thought will happen. We have invested in company called Hindustan Foods which has now become possibly the largest consumer contracting company in India in 3 years. We have invested in JHS, we sold that at 7 times, but we have invested in it which is largest oral care manufacturing company in India. They control 15 percent of oral care. I think it was about opportunity in businesses. Whereas the largest players in the businesses will get disrupted or are not changing too much for their own good, we thought there is still an opportunity. So, I think what investors, all of us need to really look at which is while there can mayhem in listed space, there is opportunity which is getting created because of mayhem. And in very point in time, someone’s loss is someone’s gain. I think there is opportunity in crises, there is crises in listed market, but there is opportunity in listed may be rare, may be few. But there is significant opportunity in guys who are disrupting the listed guys which are which is in private.

So, you are saying that companies should fan out all the alternative brands and invest in new age category because that’s where the Indian consumer space is growing, and we are not capturing that?

It brings back to me may be a decade back or 12-13 year back. If you remember when the HULs started talking about the master brand, super brand strategy getting only 30 brands in the portfolio instead of 110 that they had and they literally course corrected in three years to get that done. May be the time is right to actually say that 30 is not good for India. What makes any consumer company think that 30 is great for India? India is a 130 crore pop market, it’s a market where the consumers are experimenting, where consumer have a choice and want a choice. Disruption is happening in distribution, so it’s no longer the funnel which is becoming critical. Its no longer the HUL stranglehold, I am giving it as an example. HUL, ITC or Colgate, I think they control the distribution and thereby they thought that the product that they have put through the distribution funnel was all that the consumer wanted. That’s not true. The distribution was only an enabler, they didn’t push the brand, they didn’t put product categories, they did not innovate. Because it’s tough to innovate when you do well for yourself, you can’t disrupt yourself. I think that is changing as distribution channels change you will see lot more evolution of brands happens and thereby the costumer choice, the consumer choice will get met now. Look at what Nykaa and Purple has done in the beauty space. Unheard of. They were not brands, they were selling HUL brands, P&G brands, they were selling L’Oréal, they were selling everything around the brands created by all these guys. Today they are the platform, they are the brand. So, Nykaa is the brand which sells let’s say Rs 2,000 crore of produce. A Purple is a brand which sells Rs 500 crore of produce. They are the brand and they will get the value because they are the platform and platform has become brand. I can’t believe why a Lakme could not have done the same, or why L’Oréal should not have done it. You are killing your own brand by still targeting traditional ways of consumption and distribution because the consumer is no longer traditional. He has changed, and I think brands have not changed.

What do you think is happening to the Indian consumption space?

I think it’s very interesting. You know that I have done consumers all my life. I am not debating but I want to challenge the point which is that all the large consumer companies in India, and all of us look at that as data point and think that they their growth has slowed down from let’s say around 8-9 percent volume growth to 4-5 percent and thereby they are degrowing. But what we are looking at growth. We are looking at growth of soaps, we are looking at growth of beverages, in oral care, we are looking at growth in cigarettes and stuff like that. That is not where growth is happening. Those are markets, those are categories which have saturated themselves. So, incremental growth is always going to be slightly price-driven rather than volume-driven in those categories. But the fact is that the consumer is changing. The consumer is now consuming product in a very different fashion to what they have done historically. So, if growth is happening in the category of dips and sauces, is HUL present in dips and sauces? No. Is Knorr a brand in dips and sauces? It’s not. Is Kissan a brand in dips and sauces? It’s not but the category is growing because Indian consumers taste buds have changed because of the Pizza Huts and McDonalds of the world. We all know what mint mayo is, what a Southwest tastes like. Ideally an HUL should be capturing that space, they have not. It has taken Veeba to take leadership in the space. Maybe HUL will wake up they will get into that space sometime at some stage, but they have lost that race somewhere. That happens in every category that one looks at. Look at Bira, closer home. We all think that beer has only two price points, strong beer and mild beer, literally there is nothing else. It’s not like alcoholic space where there are multiple price points and multiple categories. But Bira has disrupted category which is almost owned entirely by United Breweries. I am not saying that they have cracked it completely, but we think they are on the way to crack it. They cracked the brand, they cracked the product proposition of saying that I am new age, I am funky, I am something which is there for the next consumers, not for the consumer of today. If I drink Kingfisher, if I did, my kids are not going to drink Kingfisher. Not because Kingfisher as a brand is poor brand or the product is poor. Its just that they don’t want to be associated with a legacy brand. So, is the case with Titan. Titan thankfully is evolving as a company, but as a brand I would think Titan in watches will over a period of time will struggle. I can’t see how legacy brands will continue to effectively use legacy for the good of growing the brand franchise that they own today. I find that to be a struggle and that to me brings core thought which is about the fact that brand loyalty is at all-time low in India. Brand awareness is at an all-time high. A perfect recipe for disruption to happen in brands.

Do you believe that the revenue scalability of these smaller business is because these are still small business. They don’t have still pan India presence, they don’t have turnover might. Do you think in next 4-5 years these businesses will grow in terms of growth and their valuations will grow further and whether the valuation of their existing businesses will come down, do you see that happening?

I remember my last call on ITC, almost a decade back. I said ITC is a sell. Not because of anything else but consumer businesses tend to behave in a particular fashion. They only do time correction; they don’t do price correction. ITC is at the same price as it was ten years back, business has grown and stuff like that, but it is at same price. So, the value has not changed but the time correction of ten years has happened. So, fundamentally they have underperformed for 10 years. The same will happen in lot of consumer businesses. You will see underperformance or time correction happening for a long period of time. It doesn’t crack as much as a lot of other businesses do because these businesses don’t require capital. It is almost like a sellers’ market in some form. That is bit of a challenge. Having said that you are in the market to make money, you are in the market to generate returns, and I am generally being overcritical of this because I want to make a point, I may be dramatizing it a bit more. What the opportunity is, it’s about the what we’ve seen in the last ten years in India. So, you look at and I don’t have precise numbers, let’s say listed market unicorns were around 25 or something in India ten years back, private market unicorn was one at that time. Today private market unicorns are 30 and listed market are just the same number. So, values are getting created. Whether these are bubbles or are actual values that investors can tangibly monetize, it’s pretty much a question right now. Having said that, the fact is that the values are precursors for what the business model delivers. I think there is disruption happening, it is slightly silent right now, but it is happening. It will become a bit noisier as we move into it because the more entrepreneurs start to feel that they have cracked the business right, they know that they have got solution for a consumer problem. Vini Cosmetics, the one with Fogg deo, they have done it in 5 years. They have done at the same point when Axe was the leader. Axe sold the product saying that you spray Axe and there will be 10 girls chasing you. Fogg came in and they said girls don’t chase you, but I am not cheating you. I will give you more buck for the product that you buy. No gas. They have changed the industry. It took one level of disruption to change what the market would be. Now Vini possibly has the ability to live through a lot more product categories. They have become innovators in that categories, whether they succeed fail is again up for debate, but the fact is that what these smaller players are showing what has never happened in India for over 50 years. The only disruption in India was Nirma which was 25 years back. There was no disruption in India for 25 years and even leaders do not disrupt their own category. You will see lot many disruptors happening because each category is calling for disruption. Look at foods, HUL has almost zero presence in food, but you will see a lot many players challenging that status. Look at personal care, personal products you have seen Purple, Nykaa really challenge that status and consumers are moving there. If I was HUL, if I was Sanjeev, I would be worried that suddenly half a million customers who were buying offline, who were buying in traditional stores which is where HUL’s strength is, suddenly moved to online Purple and Nykaa. Customer have moved, companies have not. I think, somewhere the challenge of addressing the customer’s needs, wants and attributes is not getting as defined and refined as oppose to existing leaders of listed companies as they should have been. As investor I would be worried about, as a listed market investor I would be surely worried about it. It’s not like that companies don’t disrupt themselves. I think there will be some players who disrupt their own businesses or at least be aware of disruption and capture opportunities. Look at Info Edge for example, I think they have done beautiful job from what they are doing as of now. They had a milking cow in Naukri.com and they moved in to it, they moved into Policy Bazaar and other categories. Makes complete sense of what market was calling for. I think that is what you want leaders to behave as. You want leaders to evolve and change with the time which regretfully the existing players has not really done a great job.

How are you doing that in Sixth Sense? How are you choosing businesses?

What we are doing is what pretty much what I talked about. Looking at disruptors in some form and we are not really looking at people who are trying to create an innovative product in India and thereby the change the way India consumes. We are not looking at that. We are looking at the fact that India is a great market. India is a 2 percent marke. Two percent of consumer behavior needs to be changed to a different mode of consumption and that will create one of the largest markets in India. If 2 percent of large consumer business companies start to think that contracting is the way to go, that will create a huge opportunity for contacting companies. If 2 percent of market starts thinking that drinking a new age beer is a great product to go with, we’ll create largest beer brand in India with Bira. If 2 percent of India starts to think that dips and sauces to go with, Veeba by default will be the largest category player. We have looked at lot of those players have looked at. Two percent of India says that female hygiene is the category which needs to get lot more penetrated in rural and urban India. We will create a great category pool in Paree which is Soothe Healthcare and what we have invested in. We try to invest in pockets which we believe can become large by its own nature. Obviously given the fact that these are still nascent businesses or early stage of disruption businesses, some of them will really evolve and crack it. Some of them may possibly survive from where they are today to scale up ten times and maybe plateau. But that’s how markets are. We hope that the business we have built at Sixth sense will have longer life. We hope to monetize them. We have objectives for our investor, and we will do that. But I am very happy with the way we have construed ourselves to be. We have not faulted too much till now. Hopefully we don’t or maybe we do, but we just think we have higher probability of cracking it right because we think we are getting sponsors who understood where the consumer minds are going five years forward. And that to me is the only way a consumer company can really evolve or succeed over a period of time.

Sixth Sense scores one of the best VC exits in India in recent times

Sixth Sense Ventures | June 13, 2019

https://www.vccircle.com/sixth-sense-scores-one-of-the-best-vc-exits-in-india-in-recent-times

Nikhil Vora-led Sixth Sense Ventures has generated one of the highest returns on an investment by a venture capital firm in India in recent years after fully cashing out of a consumer-focussed company it had backed barely two-and-a-half-years ago.

Sixth Sense has struck its third and final exit from Hindustan Foods Ltd and earned a nine-fold return on its investment in the contract manufacturer for fast-moving consumer goods companies, VCCircle estimates show.

This translates into an internal rate of return (IRR), or annualised return, of about 220%, the estimates show. That's far higher than the 20-30% IRR that private equity and venture capital firms typically target in rupee terms.

Sixth Sense had invested Rs 8 crore in December 2016 for a 15.4% stake in the Goa-based company, which was previously owned by diversified conglomerate Dempo Group.

It first sold a small chunk of shares last year and then a bulk of its stake earlier this year. Overall, it divested a 12.5% stake in the two tranches for Rs 56 crore.

In the final tranche, Sixth Sense recently sold the remaining 3.03% stake in Hindustan Foods for Rs 17.4 crore, regulatory filings show.

Sixth Sense's stake was bought by homegrown public markets-focussed private equity firm WestBridge Capital Partners. The PE firm now owns a stake of about 14.7% in Hindustan Foods. Its overall investment in the company is pegged at Rs 75 crore.

Vora continues to own a 4.08% stake in a personal capacity through wife Chaitali. That stake is worth upwards of Rs 23.7 crore at the current market rate.

Shares of Hindustan Foods were up 0.8% on the BSE on Thursday at Rs 432.55 apiece. The stock has traded between Rs 484 and Rs 252.80 over the past year.

However, the rationale of the stake sale in Hindustan Foods is not clear as Sixth Sense is simultaneously making a fresh investment through warrants.

VCCircle reported earlier this year that Convergent Finance, a private equity firm floated by former Fairfax India executive Harsha Raghavan, had agreed to invest in Hindustan Foods. Sixth Sense is buying warrants convertible into equity shares as part of the same deal.

An email query sent to Vora seeking comment on the divestment, returns estimates as well as warrant purchase from the second fund did not yield a response till the time of publishing this report.

This isn't the first time Sixth Sense has made a blockbuster exit. It had also made seven-fold return, or 175% IRR, on its investment from JHS Svendgaard Laboratories Ltd, which makes oral care products on contract for brands such as Dabur, Patanjali and Amway.

Separately, Vora himself had harvested multi-fold gains by selling his stake in digital wallet firm Paytm to Chinese e-commerce giant Alibaba two years ago.

How Sixth Sense is replicating founder Nikhil Vora’s Paytm success story

Sixth Sense Ventures | May 10, 2019

https://www.vccircle.com/fund-scan-how-sixth-sense-is-replicating-founder-nikhil-vora-s-paytm-success-story

Just days before SoftBank’s record $1.4-billion investment in Paytm in 2017, an individual investor’s exit from the digital wallet company with windfall gains made waves.

Nikhil Vora, an early investor in Paytm parent One97 Communications Ltd, laughed all the way to the bank with a whopping 75-fold gain on the investment by selling his stake to Chinese e-commerce giant Alibaba.

Cut to two years later, Vora’s investments from Sixth Sense Ventures is showing signs of replicating the harvest he plucked from Paytm and other personal bets that he had made before the launch of the consumer-centric venture capital firm in 2014.

“Our first fund is already at a 45% internal rate of return (IRR),” said Vora. “And with four exits completed, Sixth Sense has achieved a rare feat of possibly being the first VC fund in India to return capital to its investors within three years,” he added.

Sixth Sense’s performance sounds spectacular in an industry where the overall exit environment has been muted. So, what are Vora and his team doing right?

Intuitive investingSixth Sense is a pure-play investor in the Indian consumer value chain, covering brands, products, services, distribution and analytics. The VC firm is staying true to its cause of being a consumer fund and not getting swayed by the latest fad, which gives it an advantage over trend investing, said Vora, adding it will stick to these themes while avoiding pure tech plays, infrastructure, financial services, real estate and commodities. The VC firm’s 10 investments from the debut fund and 10 so far from the second fund have been driven by this philosophy. Together with the idea of remaining true to the sector, Sixth Sense has been guided by the idea of ‘intuit’, from which the firm also derives its name. “It is not always about how you see it but how you feel it,” said Vora, which sounds paradoxical coming from him given his experience of more than a decade at IDFC Securities crunching numbers as managing director and head of research and a much sought-after star analyst of the consumer sector. “I have been an analyst. But I don’t think it is great to be obsessed with numbers. How we look at consumer trends and investments are intuitional,” he said. Vora added that the personal investments he started making while at IDFC laid the ground to build the thesis of Sixth Sense and focus on private companies. “If you look at Fortune 500 companies, 90% of them die. Fortune 500 companies to me are symbolic of the listed companies in India that have matured and evolved. That’s not where I want to play. Tomorrow’s leaders are born today, and hence, private,” he explained.

Betting on public companiesStill, Sixth Sense hasn’t completely ruled out investing in listed firms and this strategy has earned the VC firm substantial dividends. In March, the VC firm walked home with blockbuster returns from its listed portfolio company Hindustan Foods after WestBridge Capital Partners bought its stake in the contract manufacturer for fast-moving consumer goods. It also made seven-fold returns, or 175% IRR, on its investment from another portfolio firm JHS Svendgaard Laboratories Ltd, which makes oral care products on contract for brands such as Dabur, Patanjali and Amway. “There would be themes and opportunities that could become extremely large and where the fund would love to participate,” said Vora. Major VC firms such as SAIF Partners, Sequoia Capital India and Norwest Venture Partners have also made private investments in public equities (PIPE). VCCircle, in its analysis of SAIF Partners, had detailed how the investment firm’s PIPE deals were paying off. Sixth Sense’s second fund has also bet on third-party logistics services provider AVG Logistics Ltd, which is listed on NSE Emerge, the stock exchange platform for small and medium enterprises. Vora said that increased activity in the SME exchanges has created enough liquidity for businesses to access larger pools of capital and has provided investors and shareholders an exit route. Last year, early-stage VC firm Blume Ventures’ portfolio company E2E Networks Ltd created a buzz after the cloud computing firm’s initial public offering generated an overwhelming response on the SME exchange. Vora said that the VC firm is expected to invest around 15% in listed companies from the second fund, higher than the 10% it did from the debut fund.

Doubling downThe VC firm has also re-invested in companies from its first fund by deploying capital in them from its second fund. VC firms generally avoid this investment strategy. For instance, venture firm Lightbox raised an “expansion fund” to double down on investments from its previous fund rather than putting in money from a new fund. Sixth Sense invested more in JHS, consumer healthcare products firm Soothe Healthcare and supply chain solutions firm Leap India, said Vora. The second fund will surely invest in businesses funded by the first fund if it finds the investment will give optimising returns, he added. For instance, Sixth Sense pumped more capital in Soothe, the company behind the Paree brand of sanitary napkins. This is because the business has been scaling rapidly with 10-fold growth in revenue in the last year due to increased depth in distribution. “Investments in capex in the last year has positioned Soothe well to reach peak throughput capacities of over Rs 300 crore,” Vora noted.

HiccupsWhile Sixth Sense appears to be in a comfortable position now, the VC firm had to face its share of hurdles early on when it was raising capital for its debut fund. It had originally targeted to make the final close of its maiden fund at Rs 250 crore by mid-2014. The fund, however, made the final close at Rs 125 crore ($18.5 million) in 2016. The fundraising got delayed as the firm had to incorporate certain changes in its private placement memorandum and refile its papers with capital markets regulator the Securities and Exchange Board of India (SEBI) for registration under its AIF norms. The entire first fund was raised from domestic Limited Partners including Small Industries Development Bank of India (SIDBI), several CEOs and high-net-worth (HNI) individuals. In contrast, the fundraising experience for the second fund was successful as the firm marked the final close at Rs 515 crore ($68 million) against the original target of Rs 350 crore ($54 million) within nine months. “This demonstrates the pressing need in the market for an alternative investment product with a unique approach,” said Vora. However, the VC firm also faced a drawback in the form of management churn. Founding member and managing partner Japan Vyas left Sixth Sense last year to start his own alternative asset management firm, Roots Ventures. Vyas had also worked with IDFC Securities earlier, and so did Swati Mehra, who is partner at Sixth Sense. “Everyone with years of experience wants to take a shot at entrepreneurship at one point in time. So that is the only reason why he left,” said Vora on Vyas’ resignation. Other venture capital firms such as Sequoia, Matrix, Chiratae Ventures (formerly IDG Ventures) and SAIF Partners have also seen their share of management exits even as experts stress on the need for team stability in the VC industry.

Future imperfectSixth Sense Ventures has been agile on exits, thanks largely to its listed portfolio firms as mentioned above. It also exited hyperlocal logistics company Grab with a two times return on the investment via a strategic deal with Reliance Jio, while it recorded 1.7 times returns from its investment in wedding marketplace Weddingz.in, after it got acquired by budget hospitality firm OYO (https://www.vccircle.com/softbank-backed-oyo-seals-third-buyout-acquires-weddingz-in/). While its portfolio firms from the second fund are still new, Sixth Sense’s early investments from the first fund are shaping up well and could give healthy returns. Leap India, gaming arcade operator Smaaash and speciality food ingredients maker Veeba Food have raised next rounds of funding. “I do believe that there is an extremely vibrant market for secondary (deals) in consumer businesses as that’s the only way to participate in businesses which are in high growth and do not need fresh capital,” noted Vora. Besides, Sixth Sense’s debut investment in Ethos Ltd, a subsidiary of SAIF Partners-backed watch dials maker KDDL Ltd, has tracked healthy revenue growth registering net sales of around 10% at Rs 356.09 crore in the fiscal ended 31 March 2018 after recording negative growth in the previous year. The company also swung to a net profit during the period from consecutive losses in two previous fiscal years. Vora said that the exit momentum will be maintained across the lifecycle of businesses on the back of macroeconomic growth and favourable regulatory framework. He added that Sixth Sense will continue to chase disruptors in the market that are operating in the largest and most sticky consumer categories in India. And while he has stopped making personal investments, he said he has been doing “friend-based” and “non-commercial” investments that are totally outside the purview of Sixth Sense. Whether these investments will replicate the success of the VC firm, only time will tell.

Sixth Sense Ventures scores multifold returns!

Sixth Sense Ventures | March 14, 2019

Whoa! What an eventful and fulfilling month this has been. Extremely pleased to share that Sixth Sense has possibly become the only fund in India to be in a position to return almost the entire capital back to investors within a period of less than 3 years! Interestingly, the 4 exits done were amongst the smallest investments done from the fund in terms of amount deployed! To give you a broad sense, Sixth Sense has clocked 5X returns on invested capital in less than 3 years.

Sixth Sense Ventures has scored a rare hat-trick:

·First consumer-centric domestic venture fund in India

·First alternate asset fund in India with a 0% management fee option

·Possibly - the first fund in India to return Capital back within 3 years

Our thesis and philosophy of “Investing in the Consumer of Tomorrow… Today” seems to have resonated well. While the returns as of date, are extremely satisfying, we feel completely vindicated with the fact that 2 of our portfolio companies found its way to some of the largest unicorns in India – Reliance Jio (Grab) and OYO Rooms (Weddingz.in).

Below are the details of the exits from SSIO-I:

1. Hindustan Foods Limited – Sixth Sense had invested in HFL in December 2016 at Rs40 per share and with the business doing Rs.37Cr. in revenue. We are delighted to announce that our investment has grown 9X in just over 2 years and we have significantly exited our stake to WestBridge Capital. This has to be one of the most phenomenal exits from public market investment in recent times. Would like to place on record the fantastic work being done by Sameer Kothari, CEO of HFL, as he's working to build India’s largest consumer contracting company.

2. Grab – Sixth Sense sold its stake to Reliance Jio at a ~2X in a strategic acquisition. Interestingly, Grab's founder, Pratish, in our investor conference a few months back, had eluded to the fact that a vertical specialist like Grab will eventually be a great strategic asset for some of the largest E-com players like Amazon, Walmart, Paytm or Reliance. Prophetic, I must say!.

3. Weddingz.in – The company found a new home in OYO, which took over the company assets via a BTA. The acquisition is now completely consumed, delivering a ~1.7X returns for Sixth Sense.

4. JHS Svendgaard – Sixth Sense had exited out of JHS over a year back delivering a 7X return on capital employed within 2 years.

This takes us to a total of 4 exits from SSIO-I, with a clear line of sight for the remaining six - Ethos Watches, Veeba Foods, LEAP India, Soothe Healthcare, Smaaash Entertainment and Crossroads. While business environment will always be challenging, we do believe that your investee companies/promoters are gettin! stronger by the day.

ETMGS: Alpha chasers go all out to tap Indian HNIs’ ‘play capital’

Sixth Sense Ventures | December 3, 2018

https://economictimes.indiatimes.com/markets/stocks/news/alpha-chasers-go-extra-mile-to-tap-indian-hnis-play-capital/articleshow/66919424.cms

NEW DELHI: As the traditional market gets increasingly regimented amid stiff regulations, alternative asset classes are picking up fast, both in terms of asset under management and wealth creation.

For the wealthy investors today, if you are not growing at a compounded 20-30 per cent annually, it is not considered good, says Jaideep Hansraj, CEO for Wealth Management and Priority Banking, Kotak Mahindra BankNSE 0.92 %. He was speaking at a panel discussion at the ETMarkets Global Summit , 2018.

Hansraj, who said his company has experimented a lot with wealth management products over the past 3-4 years, has seen considerable growth in this segment.

Clients largely like to keep things simple with large portion of portfolio in equity and debt, but they also like to keep play capital with which they experiment to take riskier bets. Over the last few years, there has been a huge influx of alternatives,” he said.

Andrew Holland, CEO of Avendus Capital and the man who runs India’s largest hedge fund, said it used to be either debt or equity fund earlier, but things have changed. "It is getting difficult for mutual funds to outperform each other. And investors are looking for long-term investment opportunity.”

Holland says he has a rather traditional approach to asset selection and staying ethical is as important a theme for him as are sustainability and good governance.

Shahzad Madon, Head of PMS and AIF at Reliance AMC, said the search for alpha is driving people towards PMS, which is already growing mainstream. “Our sense is that while the mutual fund industry would grow, the PMS space will grow too.”

However, he insisted that the alternative investment space does not have to become bigger than the MF space. “The focus should be on alpha generation, not on beating anyone else,” he said.

Asked specifically if the alpha creation opportunity in the Indian market has shifted to the pre-listing space, Karan Bhagat, Founder, IIFL Investment Managers, begged to differ. “The prelisting stage doesn't mean a company is low in valuation. Investors seek high returns because liquidity is higher at the prelisting stage,” he said.

Nikhil Vora, Founder and CEO at Sixth Sense Ventures, said the only way to make money is to invest in the India of tomorrow. He said Indian investors lose money largely because they hold capital. “If you don't get your breadth of investment right, then you need to worry," he said.

Vora whose venture capital fund invests primarily in the consumer oriented startups, firmly believes the leaders of today will not necessarily be the leaders of tomorrow. As many as 95 per cent leaders of today will die in a decade.” India is the most underpenetrated brand market where brand loyalty is falling and awareness is rising. Risk to experiment is much lower than before, he said. “You have a plank on innovation or disruption. Not sure India is for innovation,” Vora observed.

Kunal Upadhyay, Managing Partner, Bharat Innovation Fund, said early stage investment is tough as a lot of innovation and disruptions happen there constantly.

ETMGS: 95% of leaders today will die down in 10 years! Invest in leaders of tomorrow

Sixth Sense Ventures | November 30, 2018

https://economictimes.indiatimes.com/markets/stocks/news/etmgs-95-of-leaders-today-will-die-down-in-10-years-invest-in-leaders-of-tomorrow/articleshow/66879446.cms

NEW DELHI: Alternate investment funds (AIFs) are no longer alternatives. They are going mainstream as high net worth individuals (HNIs) hunt for higher alpha.

Investments in such avenues read close to Rs. 1 lakh crore since 2012 while mutual funds have received Rs. 9 lakh crore.

Of late, tide is turning and the AIF space is growing at an unparalleled pace.

Speaking at the second edition of ETMarkets Global Summit, leading wealth and hedge fund managers said there is enough space for services such as hedge funds, PMS (Portfolio Management Services) and venture funds to grow along with the mutual fund industry. All that matters is alpha generation.

PMS discretionary growth has been 50 per cent on a yearly basis, said Shahzad Madan, Head of PMS and AIF at Reliance AMC. The search for alpha is driving people towards PMS.

“Our sense is while mutual fund industry would grow, PMS space will also grow. Alternative investment space does not have to become bigger than MF space. Focus should on generation of alpha and returns,” Madan said.

This is what is driving people moving towards PMS space, he said.

The expectation wealthy clients have from AIF managers is that if you are not growing at 20-30 per cent compounded annually, it is not considered good, said Jaideep Hansraj, CEO for Wealth Management and Priority Banking, Kotak Mahindra BankNSE -2.62 %.

Hansraj, whose company has experimented with wealth management products over the last 3-4 years, has seen considerable growth in this segment.

According to Andrew Holland, CEO, Avendus Capital, one of India’s largest hedge funds, it used to be either debt or equity fund earlier, but things have changed.

"It is getting difficult for MFs to outperform each other," he said, whose fund grew 6 per cent in the last one year.

“Investors are looking for long term investment opportunity.”

Staying ethical, sustainability and governance are the theme to follow, Holland stressed.

Nikhil Vora, Founder and CEO at Sixth Sense Ventures, hit the nail on the head when he said the only way to make money is to invest in India of tomorrow.

But why do investors lose money? It's because they hold the capital, he put it straight.

Vora has good reasons why he believes so. "He started his venture fund to invest in leaders of tomorrow. The leaders of today are not necessarily the leaders of tomorrow. If you don't get your breadth of investment right, then you need to worry," he cautioned. “95 per cent leaders of today will die down in a decade.”

India is the most underpenetrated brand market where brand loyalty is falling and awareness is rising. Risk to experiment is much lower than before, he went on to say.

“You have a plank on innovation or disruption. Not sure India is for innovation,” Vora observed.

Karan Bhagat, Founder, IIFL Investment Managers, made an interesting point, saying prelisting stage doesn't mean that a company is low in valuation. Investors seek high returns because liquidity is higher in prelisting stage, he pointed out.

Kunal Upadhyay, Managing Partner, Bharat Innovation Fund, said early stage investment is tough as a lot of innovation is expected.

Hansraj also spoke of retail investors putting a premium on future growth potential whatever the IPO pricing is.